The Emergence and Significance of ‘FX GLOBAL CODE-2017’

Perspectives

The Emergence and Significance of ‘FX GLOBAL CODE-2017’

Mon 31 Jul 2017

The FX Global Code (Code) was finally published by the Foreign Exchange Working Group (FXWG)[1] on 25th May 2017, clearly laying down the guidelines for good practices in the FX Wholesale marketplace. With numerous scandals causing turbulence in the FX marketplace in the past, it was deemed necessary for global bodies to roll out a code which could be accepted and practiced worldwide by market participants, infrastructure providers and FX committees.

The new Code supersedes the previous code on existing guidance for the FX market participants, which was published in the Non-Investment Products (NIPS) [2]code. In the UK, the Financial Conduct Authority’s (FCA) Senior Managers regime complements the Code by requiring senior managers and certified individuals to demonstrate applicable adherence.

The FX Global code is very much in line with the EBA guidelines on FX wholesale market and indices. It echoes the work of the EBA towards effectiveness of governance in financial institutions along with protection of consumer interests. The code with its principles will further establish the guidelines set out by EBA and emphasize on the commitment from the FX wholesale market participants and providers. For instance, the global indices in FX and bullion including precious metals would also see an impact in their general framework of benchmark setting due to the combined effect of commitment to the code and prior EBA guidance on transparent methodology, clear governance, independent procedures, information being made available in public domain and appropriate regulation in FX and bullion marketplace. EBA has welcomed the roll out of FX Global code and so did the London Bullion Market Association. In fact, the LBMA published the Global Precious Metals Code on the same day, which is on similar note as of the FX Global code. However, the code is more focused towards the market participants in the OTC wholesale market for precious metals.

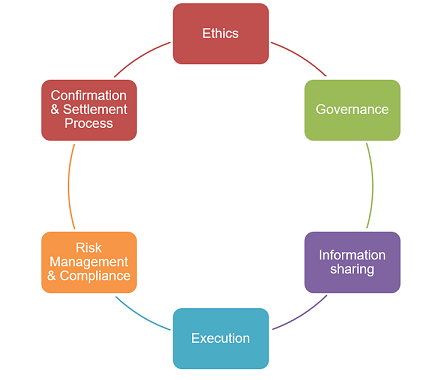

Rather than being a regulation, the FX Global Code aims to improve on the 6 fundamental principles underpinning global FX markets that transact an estimated $5 trillion a day globally, as illustrated below.

Through these 6 ”pillars”, the FX Groups aim at making the FX market place more robust, fair, open, liquid and transparent.

The Code has 55 underlying sets of principles which would lead to further improvement on ethics, governance and information sharing in the global markets. This includes tackling complex formats like electronic trading, algorithmic trading and prime brokerages. However, as FX participants, including the marketplace that they operate in, vary in terms of size, range, complexity and location of businesses, one of the key considerations for success in its adoption would be the application of principle of proportionality. For instance, any organization can infer the ideal considerations for designing a risk management framework from the Code; however an effective risk management framework which would be specific to that organization will vary significantly across market participants based on the principle of proportionality.

The critical element in this vision towards good practice in FX marketplace would be the adoption of the Code by the regulators, central banks, market participants, market infrastructure providers and FX committee members. In pursuit of that, the FXWG has also published a blueprint for adoption of the Code which is primarily centred on four broad themes:

1.Clear and Relevant code that should reflect good practice in FX market

This Code is meant to be universal and global in its application. However, due to the inclusion of the theory of proportionality, the adoption, application, adherence and demonstration of the Code would depend on the following parameters:

- Size of FX marketplace, market participants and complexity of the business activities that they undertake; and

- The regulatory environment.

2.Responsibility of market participants in incorporating and practicing the code in everyday operations

In order to achieve the desired level of adherence to the Code by market participants, a three-phased approach should be adopted. Namely; embedding, monitoring and demonstration.

As a part of embedding, the market participants should apply the Code consistently and work towards embedding it in their day to day operations to promote a strong working culture and good practices, even as a counter party. However, the participants, due to their scale and complexity of business, operations and presence in multiple marketplaces, need time to review existing policies and procedures in order to revise and update them.

In the monitoring phase, it would be crucial for market participants to monitor implementation and its impact across their own firm. In order to monitor the progress effectively, the FXWG is developing mechanisms such as a Statement of Commitment, as well as surveys to be undertaken by market participants.

After progressing through the phases of embedding and monitoring, organizations should demonstrate that they adhere to the global code in their FX operations, as well as in their internal approach to good practices as cited in the Code. Part of this might also include issuing a statement of commitment publicly or during bilateral transactions.

The Market Participants Group (MPG)[3] has been exploring ideas and options to create a public register for Statement of Commitment disclosures that participants, counterparties and clients can have easy access to.

3.Central banks can lead by example and promote good practices

Central banks have played an important role in drafting and publishing the Code and can lead by example. They intend to do so by reviewing their existing approach, policies and procedures and undergoing a gap analysis to see how they can absorb the new Code into existing procedures. FX Committee members and central bank sponsors have also arrived at a consensus to make public FXCs’ adherence to the code, provided it is consistent with the applicable rules and regulations of the marketplace that they operate in.

4.Central Banks and market participants to maintain and sustain engagement with the code

- While the participants and all related parties work towards achieving adherence to the Code, it is important that central banks and associated committees should keep the Code revised and updated.

- Agreed by the Central Bank governors, the Code is to be maintained by the FXCs through the Global Foreign Exchange Committee (GFXC), a global association of FXCs which was launched in parallel with the publication of the Code.

- The onus is on FXC member participants to promote and foster the adoption and adherence of the Code in their jurisdictions.

- The GFXC would, on regular intervals, review the new changes that have been taking place in the market place that would be relevant and applicable to the FX business. That in turn would be reflected as a change and update to existing changes.

- However, comprehensive review and revision of the Code would be done on a less frequent basis.

The key parameters that will define/grant success for/to GFXC would be:

- Market participants reflecting awareness of the Code through commitment to its principles;

- levels of transparency in the marketplace; and

- designing and implementing a broader survey to monitor progress.

The Market Committee (MC) will assess the effectiveness and relevance of the Code, following adoption by market participants after three years of launch. Until then, it will be an interesting and patient wait by the watchdogs, FXWG, FXCs and central banks to see how the industry reacts to the FX Global Code.

Article written by Swagat Bannick.

Sources:

http://www.bankofengland.co.uk/publications/Pages/news/2017/037.aspx

https://www.fca.org.uk/news/statements/fca-statement-publication-fx-global-code

http://www.bis.org/mktc/fxwg/adherence_report.pdf

https://www.fx-mm.com/news/69180/fx-global-code-conduct-goes-live-today/

http://www.globalfxc.org/fx_global_code.htm

[1] FX Working Group (FXWG) was constituted by the Bank of International Settlements (BIS) along with the Central banks and private sector market participants

[2] It applied to trading in wholesale market in Non-Investment products

[3] Market participants group comprises of inclusion from sell and buy side firms, associations and FX infrastructure providers

Want to get notified when new blog posts are published?

Subscribe