Is the German market the new Eldorado for Real Estate in Europe?

Perspectives

Is the German market the new Eldorado for Real Estate in Europe?

Wed 15 Mar 2017

The figures speak for themselves: real estate investments in Germany rose to almost €66 bn in 2016, reaching almost €20 bn in the final quarter excluding residential, according to BNP Paribas Real Estate. Germany is now challenging the UK as the main European market, and some see it as the safest investment area following Brexit. Berlin and Hamburg regularly top the rankings for cities in which to invest. One sure sign is the fact that foreign investors represent almost 43% of flows over the year. All sectors are still active: offices, commerce, hotels and residential. What are the reasons for this success? We identify four.

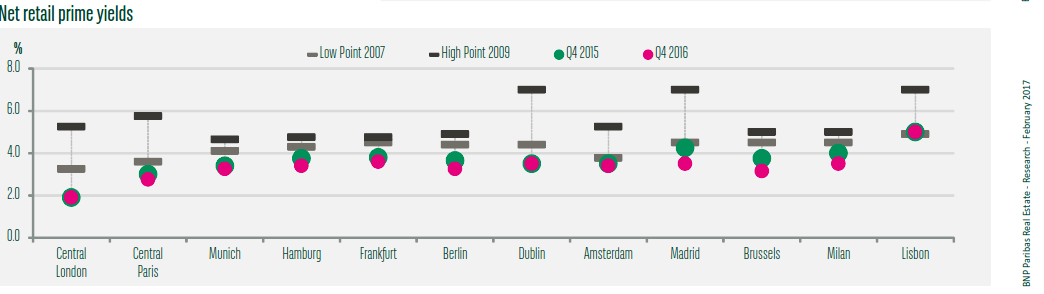

(*Munich, Hamburg, Frankfurt, Berlin)

(*Munich, Hamburg, Frankfurt, Berlin)

1. A prosperous economy

There is no doubt that Germany is the star pupil among major European countries. 2016 ended with GDP growth of 1.9%, a budget surplus of 0.6% with a record trade surplus, and unemployment falling to a new low of 4% – effectively, full employment. What could be better?

Against this background, it’s no surprise that investors are flocking to Germany, especially given the increasing instability elsewhere.

2. A haven of stability in an ever-more uncertain world

Geo-political uncertainties have increased in recent months. Without question, the risks are greater today than at any time in the last 25 years and more. Conflict areas in Africa and the Middle East, the return of a hegemonic Russia to the international stage, Brexit, the election of Trump in the United States and the resulting uncertainties, the actual or potential assumption of power by populist political parties in Poland, Southern Europe or even France, together with a European Union that is hard to fathom and that is seen as remote from public concerns: it all combines to make Germany look like an island of stability, with a clear policy (even if, as in the case of immigration, sometimes challenged), and embodied by a leader: Angela Merkel. In this context Germany stands out as a stable area for real estate investment, and its outlook is also promising.

3. Buoyant rents and still-attractive real estate yields

Over the last five years, rents in the main German cities have been more than buoyant, recording continuous growth. For example, since 2011:

- Retail: prime rents per m² have risen by an average of 7% annually in Berlin, and within a range of 3.4% to 5.5% in cities such as Düsseldorf, Frankfurt, Munich and Hamburg;

- Offices: prime rents per m² have risen by an average of 3.3% annually in Berlin, and within a range of 2% to 2.7% in cities such as Düsseldorf, Frankfurt, Munich and Hamburg;

- Residential: rents per m² have risen by an average of 5.2% annually in Berlin, and within a range of 2.1% to 4.5% in cities such as Düsseldorf, Frankfurt, Munich and Hamburg.

Whatever the sector, yields in the major German cities remain attractive for investors. Since 2007, it has been clear that the prime retail and prime office sectors have been less affected by market cycle fluctuations than in other major European cities such as London, Paris, Dublin and Madrid.

4. All this, and the new German cultural appeal

To all this we can add a new lively side that has emerged in Germany, embodied in the city of Berlin with its exuberant artistic life and its start-ups; or in radically different real-estate projects like the Elbphilharmonie concert hall in Hamburg (see the photo below).

Germany no longer has the dull, grey image of old. Little by little it has built up a new aura, adding an unexpected touch of innovation and originality to its reputation for quality and seriousness and thus combining economic, political and cultural appeal. Who would have thought it?

Article written by Gilles Magnan, Baptiste Kalasz and Alexandre Kasse.

[see_also link=”URL” target=”_blank”][/see_also]

Want to get notified when new blog posts are published?

Subscribe