Russian sanctions: what implications for financial institutions?

Perspectives

Russian sanctions: what implications for financial institutions?

Thu 28 Jul 2022

Following Russia’s annexation of Crimea in March 2014, the United States (US) and the European Union (EU), together with other countries, imposed mainly economic sanctions on Russia. Since Russia’s recognition of the self-proclaimed autonomous republics of Donetsk and Lugansk, followed by Russia’s attack on Ukraine on 24 February 2022, these sanctions have taken on new significance for financial institutions.

This article summarises all the sanctions taken by the US and the EU since 21 February against Russia; all the sanctions imposed by the UK are presented in the appendix #11. Please note, measures taken by other countries or against Belarus are not be presented (e.g. Japan, Australia, etc.).

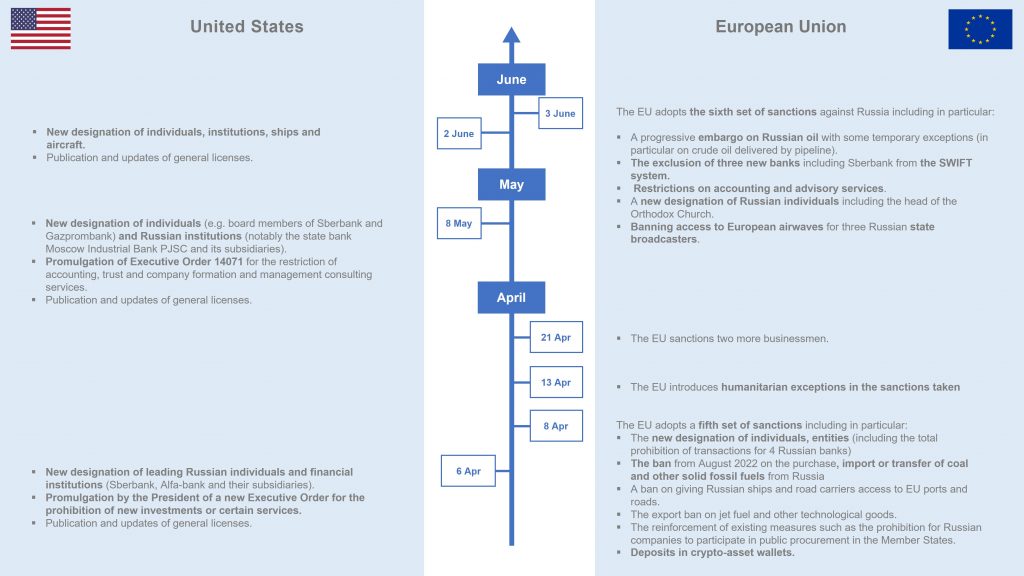

Key dates of the sanctions against Russia

The table below shows the key dates of the sanctions taken by the US and the EU between 24 February and 3 June 2022:

On 5 April, the EU has proposed to take sanctions a step further. The EU will make them broader and sharper so that they cut even deeper into the Russian economy. This fifth package has six pillars:

- an import ban on coal from Russia,

- a full transaction ban on four key Russian banks, among them VTB,

- a ban on Russian vessels and Russian-operated vessels from accessing EU ports

- further targeted export bans, in areas in which Russia is vulnerable (for example quantum computers, advanced semiconductors and sensitive machinery and transportation equipment)

- specific new import bans on products from wood to cement, from seafood to liquor

- very targeted measures, such as a general EU ban on participation of Russian companies in public procurement in the Member States.

Implications for financial institutions

Faced with this changing regulatory context, the operational implications for financial institutions are numerous and include various challenges:

- Human: ensuring the management and safety of teams and employees directly or indirectly involved in their subsidiaries in Ukraine, Russia or bordering countries.

- Regulatory: the daily evolution of sanctions against Russia and Belarus creates a challenge for deciphering and interpreting decisions. Thus, banks are recommended to have regulatory and legal experts constantly on hand.

- Cyber risk: an increased risk of cyber-attack, particularly for financial institutions, means reinforced vigilance is strongly recommended. For example, the French National Agency for Information Systems Security (ANSSI) recommends implementing priority preventive measures for French companies.

- Communication: as in any crisis, whether health, economic or humanitarian, communication is a key issue, particularly where certain subsidiaries may be located in the territories concerned. Companies must be transparent with both their employees and their customers. As the situation evolves, it is essential that our clients adopt an appropriate crisis communication strategy.

- Reputational: due to the media coverage of the conflict, financial institutions must examine their strategy of having a direct or indirect presence in the conflict zones.

- Financial: the impact on activities and associated commercial consequences can be significant. Indeed, ensuring the continuity of activities in Russia or Ukraine can be a real challenge. Faced with such uncertainty, our clients also need to assess the various capital impacts of a critical scenario that would affect, for example, the property rights of assets held in Russia.

- Organisational: for French financial institutions in particular, there is a marked increase in alerts related to sanctions because of the many related homonyms. This can have a significant business impact given the large number of blocked transactions awaiting analysis. Consequently, financial institutions need to strengthen their team to absorb this additional burden as soon as possible. This will help limit the accumulation of unprocessed alerts and increase their processing time.

Ten key themes of the sanctions taken

The sanctions taken by the US and the EU against Russia can be summarised according to the following ten themes:

- Global economic sanctions on territories

- Sanctions against individuals, officials and entities

- Sanctions against Russian financial institutions

- Sanctions on specialised payment message services (SWIFT)

- Sanctions on capital markets and credit rating services

- Sovereign debt sanctions

- Penalties relating to foreign currency transactions

- Penalties relating to cash deposits

- Sanctions against certain sectors of the economy

- Other measures taken

Discover the details of the sanctions in the appendices below.

Appendices

1. Global economic sanctions on territories

United States

The US President has issued extensive sanctions against the People’s Republics of Luhansk and Donetsk via the Executive Order on “Blocking Property of Certain Transactions With Respect to Continued Russian Efforts to Undermine the Sovereignty and Territorial Integrity of Ukraine”.

Therefore, and in the absence of an Office of Foreign Assets Control (OFAC) licence, the following are prohibited:

- any new investment by a US person, wherever located;

- importing into the US, directly or indirectly, any goods, services, or technology from the targeted regions;

- the export, re-export, sale or supply, directly or indirectly, from the US, or by a US person, wherever located, of any goods, services or technology to the targeted regions; and

- any endorsement, financing, facilitation or guarantee by a US person, wherever located, of a transaction effected by a non-US person.

European Union

The EU Council has published Regulation 2022/263, which provides for restrictive measures against areas of Donetsk and Luhansk oblasts not controlled by the Ukrainian government, such as:

- a ban on importing goods originating in the designated territories into the EU;

- restrictions on trade and investment in certain sectors of the economy;

- a ban on providing tourist activity services; and

- banning the export of certain goods and technologies.

2. Sanctions against individuals, officials and entities

United States

Sanctions against Specially Designated Nationals (SDNs) to include:

- multiple members of the Government of the Russian Federation, including Vladimir Putin and Sergei Lavrov;

- several influential Russian personalities close to President Putin, and people occupying positions of power within the Russian State or Russian financial institutions;

- several entities;

- several vessels; and

- multiple aircraft.

European Union

Sanctions against designated listed persons to include:

- 216 individuals, including members of the Russian National Security Council, accused of supporting Russian recognition of the Donetsk and Luhansk regions, including Vladimir Putin and Sergei Lavrov;

- several prominent Russian personalities;

- 18 entities such as the Internet Research Agency and SOGAZ;

- 336 members of the Duma who voted in favour of recognising the independence of the republics of Donetsk and Lugansk; and

- 146 members of the Federation Council of Russia.

In addition, the EU, under Regulation 2022/428, has prohibited all transactions with 12 Russian public companies and their subsidiaries already subject to refinancing restrictions.

3. Sanctions against Russian financial institutions

United States

SDNs of the following ten financial institutions and their subsidiaries. The rule of 50% direct or indirect holding applies:

- Promsvyazbank (PSB)

- Development Bank of the Russian Federation Vnesheconombank (VEB)

- Vnechtorgbank (VTB)

- PJSC Otkritie

- Novikombank

- Sovcombank

- Russian Direct Investment Fund

- Sberbank

- Alfa-Bank

- Moscow Industrial Bank PJSC

OFAC has updated FAQs and issued new blanket licences to provide clarifications and explanations regarding the actions taken and conditionally authorise transactions with designated institutions.

In addition, the US has imposed CAPTA list sanctions relating to correspondence accounts and transit accounts on the largest bank in Russia, Sberbank, and its subsidiaries. This action was taken under OFAC Directive 2 pursuant to Executive Order 14024. Thus, with effect from 26 March 2022, US financial institutions are prohibited from engaging in the following activities:

- opening or maintaining correspondent accounts or clearinghouse accounts for, or on behalf of, Sberbank and its related assets or interests; and

- the processing of Sberbank transactions and related assets or interests.

European Union

The EU has imposed asset-freeze measures against the following seven Russian financial institutions:

- Promsvyazbank (PSB)

- Development Bank of the Russian Federation Vnesheconombank (VEB)

- Rossiya Bank

- PJSC Otkritie

- Novikombank

- Sovcombank

- Vnechtorgbank (VTB)

However, the regulation provides for a derogation making it possible to authorise the release of funds from designated financial institutions under certain conditions defined by the competent authorities of the Member States.

4. Sanctions on specialised payment message services (SWIFT)

European Union

On 2 March 2022, the EU Council introduced new restrictive measures via two new regulations: 2022/345 and 2022/350.

Through these regulations, the EU excludes certain Russian banks from the SWIFT system, which prevents them from carrying out transactions on a global scale. The exchange of financial data via SWIFT has therefore been prohibited since 12 March 2022 for the following seven banks:

- Promsvyazbank (PSB)

- Development Bank of the Russian Federation Vnesheconombank (VEB)

- Vnechtorgbank (VTB)

- PJSC Otkritie

- Novikombank

- Sovcombank

- Rossiya Bank

As part of the 6th package of sanctions, exchanges via SWIFT are also prohibited from 14 June 2022 for an additional three Russian banks:

- Sberbank

- Credit Bank of Moscow

- Russian Agricultural Bank

5. Sanctions on capital markets and credit rating services

United States

OFAC has issued Directive 3 under Executive Order 14024, which prohibits all transactions by US persons or in US territory involving new debts with a maturity greater than 14 days, or new claims for the benefit of 13 entities listed in Appendix 1 of this Directive and their subsidiaries.

It should be noted that these prohibitions apply to all new debts or receivables issued from 26 March 2022 (0:01 am Eastern time) regardless of the currency.

European Union

In addition to the measures taken in 2014 against 24 financial institutions, direct or indirect transactions involving the purchase, sale, provision of investment services or assistance in issuing securities and money market instruments with a maturity of more than 30 days issued after 12 April 2022, are prohibited.

In addition, it is prohibited to enter into an agreement to grant new loans or credits to these entities.

EU central securities depositories are prohibited from providing services for securities issued after 12 April 2022 to Russian nationals, natural persons resident in Russia, or legal persons, entities or bodies established in Russia.

It is prohibited to sell transferable securities denominated in euros issued after 12 April 2022 or units of undertakings for collective investment offering exposure to these securities to Russian nationals, natural persons residing in Russia, or legal persons, entities or organisations established in Russia.

An extension is made on the restrictions concerning euro denominated transferable securities. It is now prohibited to sell securities denominated in any official currency of a Member State issued after 12 April 2022.

Note that the definition of transferable securities has been revised to include transferable securities in the form of crypto-assets.

In addition, from 15 April 2022, the EU prohibits the provision of credit rating services, as well as access to subscription services related to credit rating activities to any Russian national, an individual residing in Russia or any legal person, entity or body established in Russia.

6. Sovereign debt sanctions

United States

OFAC first issued Directive 1A under Executive Order 14024, which clarifies Directive 1 of Executive Order 14021. Directive 1A extends to the secondary market and prohibits US financial institutions from participating in transactions involving bonds denominated in ruble or any other currency issued after 1 March 2022 by the Central Bank of Russia, the sovereign wealth fund or the Ministry of Finance of Russia.

Further, Directive 4 issued by OFAC prohibits US Persons from carrying out any transaction that would involve these entities.

European Union

The EU has approved the following measures against Russia regarding sovereign debt, namely:

- all activities involving transferable securities and money market instruments issued after 9 March 2022 are prohibited;

- any financing such as a credit or a loan from 23 February 2022 is prohibited;

- additional restrictions for the Central Bank of Russia: transactions related to the management of the reserves and assets of the Central Bank of Russia, including transactions with any legal person, entity or body acting on behalf of or on the instructions of the Bank Central Russian are prohibited;

- Russian Direct Investment Fund (RDIF) Restrictions: Investing in, participating in, or otherwise contributing to RDIF co-funded projects is prohibited.

7. Penalties relating to foreign currency transactions

United States

It is prohibited to export, sell or supply U.S. dollar notes from the United States, or by a U.S. person, to the Russian government or to anyone located in Russia.

European Union

The EU has adopted a measure prohibiting the sale, supply, transfer or export of banknotes denominated in any official currency of a member state to Russia or for use in Russia.

This measure does not apply to the personal use of natural persons travelling to Russia, their close relatives travelling with them or for the official purposes of diplomatic, consular missions or international organisations in Russia with immunities in accordance with international law.

8. Sanctions relating to cash deposits

European Union

Credit institutions are prohibited from accepting deposits if the total value of the deposits exceeds 100,000 euros from:

- Russian nationals;

- natural persons residing in Russia;

- legal persons;

- entities or organisations established in Russia.

Please note that this prohibition does not apply to:

- nationals or natural persons holding a temporary or permanent residence permit from a Member State, a member country of the European Economic Area or Switzerland

- deposits necessary for cross-border trade not subject to the ban on goods and services between the European Union and Russia.

9. Sanctions against certain sectors of the economy

United States

Restrictions on new investments and certain services: since Executive Order 14071 of 6 April 2022, a ban on new investment in the Russian Federation by a U.S. person, wherever located, and a ban on export, re-export, sale or provision of all types of services to anyone located in Russia. Further, the endorsement, financing, facilitation or guarantee by a U.S. person of any transaction conducted by a non-U.S. person that would have been prohibited if performed by a U.S. person. The services covered by these restrictions are certain services related to accounting, the establishment of trusts and companies and management consulting services.

Restrictions on the energy sector: according to Executive order 14066, prohibition of imports into the US of certain energies such as Russian oil, gas and coal. In addition, all new investments in the Russian energy sector by a US person wherever located are prohibited.

Restrictions targeting sensitive sectors (defence, aerospace and maritime): a Final Rule has been published by the Bureau of Industry and Security of the US Department of Commerce with the objective of tightening controls on exports to Russia in the defence, aerospace and maritime sectors.

Restrictions on other key sectors of the economy: according to Executive order 14068, ban on seafood, alcoholic beverages and non-industrial diamond imports into the US. In addition, the export, sale and supply of Russian luxury goods from the US or by a US person wherever located is prohibited.

European Union

Restrictions on the energy sector: ban on selling, supplying or exporting goods and technologies that can be used for oil refining, ban on new investments in the Russian energy sector and restriction on export of equipment, technologies and services for the energy sector. It is also prohibited to purchase, import or transfer, directly or indirectly into the European Union, coal and any other solid fossil fuel if they originate in Russia.

The 6th package of sanctions against Russia prohibits the purchase, import or transfer of crude oil or petroleum products as listed in the dedicated annex of Regulation 2022/879. Temporary exceptions and derogations apply (e.g. on crude oil delivered by pipeline or on crude oil imported by sea and vacuum diesel for Bulgaria and Croatia). Restrictions also apply to the transport of crude oil or petroleum products. In addition, and in the event of sudden interruptions in supply, emergency measures will be introduced to ensure security of supply.

Defence Sector Restrictions and dual-use goods: ban on the sale, supply or export of defence sector goods and technologies to Russia and extension of restrictions on dual-use items and technology.

Restrictions on the maritime sector: ban on the sale, supply or export to Russia of goods and technologies relating to maritime navigation and radiocommunication technologies.

Restrictions on the aeronautics sector: ban on the sale, supply or export to Russia of aircraft, aircraft parts and equipment and financial services associated with aircraft. In addition, restrictions have been taken to prevent Russian airlines and aircraft registered in Russia from landing, taking off or flying over EU territory.

Restrictions affecting the road transport sector: prohibition for Russian carriers or carriers established in Russia to transport goods by road on the territory of the European Union.

Restrictions on the steel sector: ban on buying or importing iron and steel originating in or coming from Russia.

Restrictions targeting the luxury sector: prohibition to sell, supply or export luxury goods and products to Russia as specified in Annex VIII of Regulation 2022/428 if their value exceeds €300 per item unless otherwise specified in the appendix.

Restrictions on goods generating significant profits: The European Union specifies in EU Regulation 2022/576 that it is prohibited to purchase or import goods which generate significant revenue for Russia. The goods concerned are specified in Annex XXI of the regulation (including, for example, shellfish, caviar, cement, fertilizer and wood products).

Restrictions on goods likely to contribute to the strengthening of Russian industrial capacities: The European Union specifies in EU regulation 2022/576 that it is prohibited to sell, supply or export goods likely to contribute to the strengthening of Russian industrial capacities. industrial capabilities of Russia. The goods concerned are specified in Annex XXIII of the Regulation.

Restrictions on certain services: As part of its 6th set of sanctions, the European Union specifies that it is prohibited to provide the Russian government or entities established in Russia with accounting, auditing services (including statutory audit), bookkeeping, or tax advice, or business advisory services and management or public relations services.

10. Other measures taken

European Union

The EU has taken additional restrictive measures since the beginning of the conflict. These include diplomatic actions such as the suspension of summits between the EU and Russia and restrictions against Russian public media including the suspension of broadcasting activities in the Union of Sputnik and Russia Today.

11. Sanctions imposed by the United Kingdom

United Kingdom

22 February 2022: Asset freezes on various Russian banks, oligarchs, and Russian politicians who voted to recognize the independence of the Ukrainian regions

25 February 2022: Asset freezes on President Putin and Russian Foreign Minister

01 March 2022:

- Asset freezes on Belarusian Chief of the General Staff and other senior members of Belarusian armed forces.

- Asset freeze against Russian Direct Investment Fund and its CEO

- Shipping sanctions, including preventing certain Russian ships from UK waters

- Restrictions on providing financial services to the Russian Central Bank

24 February 2022: Asset freezes on certain Russian banks, defence companies, and oligarchs. Export controls to restrict UK shipments to Russia and Aeroflot banned from flying in UK airspace.

26 February 2022: Various Russian banks frozen out of the international financial system via SWIFT

09 March 2022:

- Import ban on Russian oil which will be phased out over the duration of 2022

- Aircraft ban from flying over or landing in the UK

- Export ban of aviation or space-related items and technology to Russia

- SWIFT ban extended to Belarus.

10 March 2022: Asset freezes and travel ban on Roman Abramovich (owner of Chelsea Football Club) and. 6 other Russian individuals.

11 March 2022: Asset freezes and travel ban of 386 members of the Russian Duma, who voted in favour of the invasion of Ukraine.

14 March 2022: New Economic Crime (Transparency and Enforcement) Act passed which introduces further sanctions powers.

15 March 2022:

- Export ban of high-end luxury goods and new import tariffs on hundreds of key products (such as Russian vodka) that represent a 35-percentage point hike on current rates

- Cessation of all government-backed export finance to Russia and Belarus, including prohibiting loans and guarantees

16 March 2022: Launch of Russian Elites, Proxies, and Oligarchs (REPO) multilateral task force, to demonstrate the international support for Ukraine and enforce sanctions.

17 March 2022: Suspension of exchange on tax information with Russia and Belarus, including Exchange of Information on Request, Common Reporting Standard or Country-by-country Reporting.

24 March 2022:

- Asset freezes of additional Russian banks, Russian defence, and other strategic industries.

- Asset freezes of additional Belarus businesses and strategic industries.

Want to get notified when new blog posts are published?

Subscribe